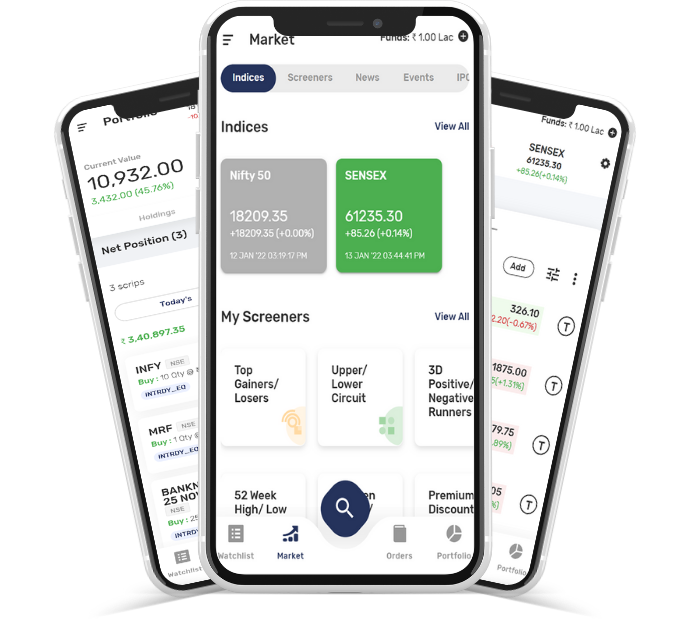

Empower your trades with IGSL Trade App

Where seamless functionality meets powerful insights for a smarter trading experience.

15k+ Downloads

4star Rating

Quick & Easy

Pioneering Financial Solutions for 25 Years

For the past 25 years, Inventure Growth has been a stalwart provider of financial services, serving clients across every corner of India.

With a commitment to excellence and innovation, we've forged lasting partnerships and empowered countless individuals and businesses to achieve their financial goals. Our unwavering dedication to integrity, expertise, and personalized service continues to drive our success as

we navigate the dynamic landscape of the financial industry.

75K+

75K+ esteemed customers, for propelling us forward and shaping our success together.

200+

Invaluable experience within our company enriches our endeavors, shaping success and fostering growth for all.

400+

Our success thrives through the synergy of 400+ valued partners.

25+

25 years of financial expertise, guiding success and shaping futures with integrity, innovation, and dedication.

Tools to give you ease of trading environment

Mutual Funds

Offering expert services which result in tailored solutions to navigate market complexities and optimize investment outcomes, ensuring financial goals are achieved with confidence and precision.

International Market

Go global with Inventure Growth! Our platform unlocks a world of investment opportunities by connecting you to international stock exchanges. Advanced tools and expert guidance, ensuring smooth execution for success in the global market.

Grow with Us: Partner with Inventure Growth

Partner with us and chart a course for shared prosperity. We'll open doors to exciting possibilities and empower each other to achieve exceptional results in the ever-evolving financial landscape

Become a partner

IGSL Trade: Your Gateway to Seamless Trading with Inventure

Invest easily and efficiently with the IGSL Trade app by Inventure. Our user-friendly platform provides powerful tools for trading stocks, commodities, currencies, and more, helping you make informed decisions which may led to optimal investment outcome.